irvine property tax rate

The Rent Zestimate for this home is 1500mo which has increased by 23mo in the. Select the California city from the list of popular cities below to see its current sales tax rate.

Orange County Ca Property Tax Calculator Smartasset

Headquartered in Irvine Calif CoreLogic operates in North America Western Europe and Asia Pacific.

. Zestimate Home Value. All other marks contained herein are the property of their respective owners. Businesses impacted by the pandemic please visit our COVID-19 page.

When you decide to sell your house or embark on major construction your property will be eligible for a value reassessment on a total market value in California. 2902 Irvine Ave NW Bemidji MN is a single family home that contains 1480 sq ft and was built in 1946. To Assuming the same facts as above except you did not submit your tax return until June 3.

Online videos and Live Webinars are available in lieu of in-person classes. Californias taxation code allows for a tax exclusion for properties that qualify for new solar installations. Please contact the local office nearest you.

It contains 3 bedrooms and 2 bathrooms. Tax Title Services offers the fastest and most efficient tax title process with our title fees kept as low as possible. Search by tax year and assessment number tax year.

1 949 798-1180. The report notes that homeowners in majority Latino neighborhoods save an average of 3098 per year in property taxes thanks to Proposition 13 compared to if they had to pay taxes based on the. The gross shaded rental income less investment property cost is added to the taxable gross income to determine the marginal tax rate and calculate net income.

135 West Irvine Street Suite B01 Richmond KY 40475. 2 Pay in person at the Sheriffs Office Mon Fri 800am 430pm. The Zestimate for this house is 197400 which has decreased by 629 in the last 30 days.

2051 Little Rock Rd Irvine KY is a single family home that contains 1600 sq ft. Get your property certification in just 30 calendar days. For questions about filing extensions tax relief and more call.

View all of our election coverage. Welcome to Residence Inn Irvine John Wayne AirportOrange County. Within the total the annual growth rate of credit card borrowing was 116 marking the highest rate since November 2005 the Money and Credit report said.

The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. For more information.

The Zestimate for this house is 146000 which has decreased by 713 in the last 30 days. CDTFA public counters are now open for scheduling of in-person video or phone appointments. The Rent Zestimate for this home is 850mo which has increased by 850mo in the last 30 days.

The property tax rate in the county is 078. Your tax amount due is 1000 and payment is due on or before April 30. California has recent rate changes Thu Jul 01 2021.

With local taxes the total sales tax rate is between 7250 and 10750. Unsecured property tax bills related information search by tax collector reference number tcref number eg. Most Ada County residents probably dont look forward to their yearly property tax assessment these days.

Languages spoken by staff. It contains 2 bedrooms and 1 bathroom. It is good.

Accident Lawyer Divorce Attorneys Family Law Attorneys Lie Detector Tests Private Investigators Process Servers Stenographers Tax Attorneys. A rise in the energy price cap council tax increases and a 125 percentage point rise in National Insurance NI to pay for health and social care were among the higher costs in April. Pets 75 pounds max allowed with USD 150tax non-refundable fee per room per stay.

The definition of a dependent has changed from a child under the age of 18 to include a child 18 years or over who lives with the applicants and is totally financially reliant. The property tax bill lists the assessed value of your personal property the tax rate applied by various jurisdictions such as the state county and school system and the subtotal of each. Property Tax.

Tax Title Services 18302 Irvine Blvd Suite 260 Tustin CA 92780 1 949 798-1180. On May 17 four Republicans will be hoping to earn your vote to become the countys next Assessor and lead the office in charge of analyzing sales data and other information to assess your propertys value and run the Ada. Residential Tax Solutions Commercial Tax Solutions.

Similarly property with high basis can be allocated to a spouse that will be in a higher marginal bracket. The rate for early-stage delinquencies defined as 30 to 59 days past due was 13 in February 2022 down from 15 in February 2021. However you do not make your tax payment until May 20 and the adjusted interest rate shown at the bottom of your tax return is 0075 9 12.

The payment happens through an increased property tax bill. A spouse that will end up taking on. Now you would owe twice.

The ability to take advantage of Section 1041 allows taxpayers to shift property with significant amounts of built in gain to a spouse that will have a lower marginal tax rate after the divorce.

Orange County Property Tax Oc Tax Collector Tax Specialists

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Pin On Platinum Mortgage Company

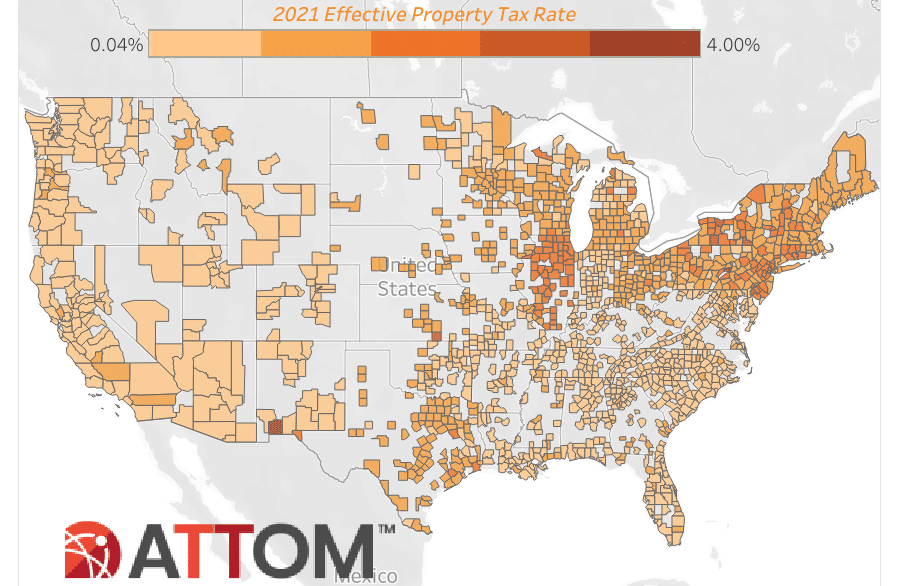

U S Property Taxes Levied On Single Family Homes In 2018 Increased 4 Percent To More Than 304 Billion Attom

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Kentucky Property Tax Calculator Smartasset

Exterior Beverly At Eastwood Village In Irvine Ca Brookfield Residential Brookfield Residential New Homes Residences

Realtymonks One Stop Real Estate Blog Tax Attorney Property Tax Tax

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Orange County Rush To Pay Property Taxes Boosts Collections 9 Fold Orange County Register

Orange County Ca Property Tax Calculator Smartasset

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Why Rent When You Can Own Check Out Our Five Main Reasons Why You Should Buy A Home Today Call Us Toll Free At 888 544 Home Buying Real Estate Marketing Rent

Understanding California S Property Taxes

Appealing Your Property Taxes Consider Expert Help Tax Attorney Property Tax Tax

Why Property Taxes Are Significantly Higher In The Great Park Neighborhoods Cfd 2013 3 And It Doesn T Sunset Irvine Watchdog

Understanding California S Property Taxes

How To Calculate Property Tax Everything You Need To Know New Venture Escrow